Deep Dive 13: Vertiv (VRT) - Infrastructure

Preface

Vertiv is a critical digital infrastructure provider at the center of the data center boom fueling generative AI, hyperscale cloud, and edge computing.

The comoany just announced Q1 2025 results - they were strong and (mostly) free of tariff risk. The stock is down 27% YTD and nearly 45% from its high reached in January of this year.

The company’s top customers inlcude the following:

• Alibaba

• America Movil

• AT&T

• China Mobile

• Equinix

• Ericsson

• Siemens

• Telefónica

• Tencent

• Verizon

• Vodafone

• Amazon Web Services (AWS)

• Microsoft

This dossier provides a comprehensive look at Vertiv’s technology portfolio (power, cooling, modular data centers) and analyzes how the company is positioned for the AI infrastructure surge.

We also examine Vertiv’s latest Q1 2025 financial results, the impact of tariffs on its supply chain and costs, and the competitive landscape of global rivals.

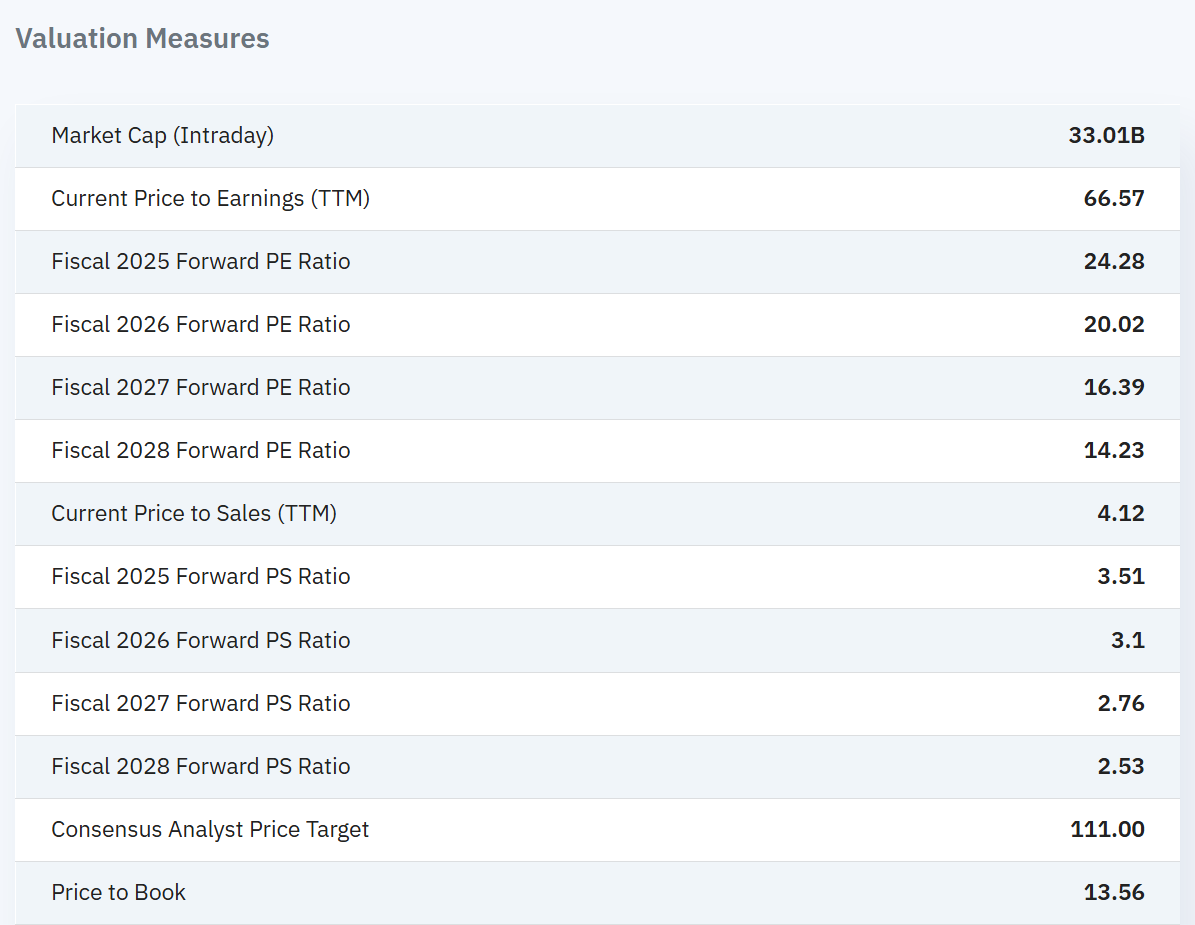

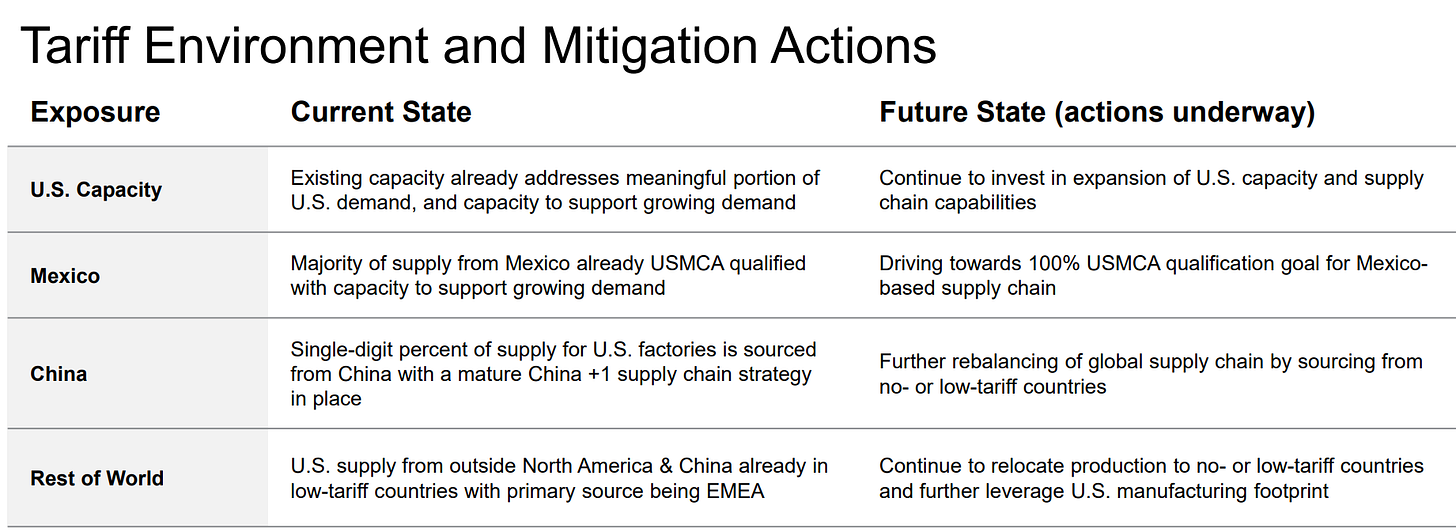

The current valuation appears appropriate: neither stretched nor cheap:

Tell It to Me Like I’m 11-years Old

Easy Button: Imagine you have a giant computer playground that needs to be always on and never get too hot.

Vertiv is like the team of builders and electricians who make sure the playground has plenty of electricity and AC cooling so the computers can play (work) all day and night safely.

They even build pre-made mini computer rooms that can be set up quickly, kind of like big LEGO blocks for computers, so that new gaming arenas (data centers) can pop up fast when more power is needed.

Let’s break it down in kid terms: Big companies have huge rooms filled with computers (these rooms are called data centers – think of a warehouse full of stacked PlayStation or Xbox consoles, but for work).

These super-computers do cool things like run AI programs that can talk or draw (just like ChatGPT or an art AI), but they get really hot and they need electricity all the time.

If they overheat or lose power even for a second, it’s a big problem – kind of like your game console shutting off right when you’re about to win.

Vertiv’s job is to keep those big computer rooms safe and happy.

They make huge battery packs and power devices that act like a super charger – if the main power goes out, Vertiv’s machines instantly give backup power so the computers don’t even blink (imagine never losing your Minecraft progress because the power never goes out!).

They also make the giant air conditioners and coolers that blow cold air or pump cold liquid to stop the computers from overheating (just like a fan keeping your gaming PC cool, but much bigger).

Essentially, Vertiv’s machines are the reason the super clever AI computers don’t “get a fever.”

Now, when lots of people want to use AI or the internet, companies need to build more of those computer rooms quickly.

Instead of taking forever to build a new building, Vertiv can build a ready-made data center in a factory – with all the racks (like shelves for computers), power, and cooling inside – and then ship it out.

Think of it like a prefab treehouse kit: all the pieces come ready, you just put it together and voilà, you have a new place for computers in much less time.

This helps bring computers closer to where people use them (for example, a small data center in your town to make your video streams faster is like having a local playground instead of traveling far).

So in simple words: Vertiv makes sure the supercomputers behind AI and the internet have “electricity juice” and “cooling air” all the time, and they even provide pop-up computer rooms wherever needed.

Without companies like Vertiv, those magic AI programs and websites we use might go dark or overheat.

Vertiv is working hard to support the future of AI and cloud – building the “homes” for computers that let our digital world keep growing safely.

Vertiv’s Critical Infrastructure Portfolio

Easy Button: Vertiv makes the hardware that keeps data centers running – think of big battery backups, power equipment, and cooling systems that ensure servers stay on 24/7 without overheating.

They also build modular data center units (like pre-made server rooms) that can be quickly installed wherever extra computing power is needed.

Vertiv’s business revolves around providing the “physical backbone” for data centers and other critical facilities.

In practice, this means a broad portfolio of products and solutions across power, cooling, and integrated enclosures that keep digital operations running smoothly.

Here’s an overview of Vertiv’s main product areas and what they do:

• Power Infrastructure Solutions: Vertiv supplies the equipment that delivers reliable electricity to servers and networking gear.

This includes uninterruptible power supply (UPS) systems (essentially giant battery backups that kick in if the grid power falters), power distribution units, switchgear, and transfer switches that route electricity efficiently.

Vertiv’s UPS systems (like their Liebert® series) often use battery banks – increasingly lithium-ion – to provide backup power.

They also offer battery energy storage systems (BESS) and power management software to ensure stable power quality.

In effect, Vertiv’s power products keep critical tech online through outages and manage the huge power loads that modern data centers require (which can be tens of megawatts for large sites).

• Thermal Management (Cooling) Solutions: Data centers generate tremendous heat with thousands of servers packed together, and Vertiv’s cooling technologies remove that heat to prevent failures.

Vertiv’s thermal management line (formerly the Liebert cooling brand) ranges from room-scale air conditioners to high-tech liquid cooling.

They provide computer room air conditioning (CRAC) units, chilled water systems, and air handlers that keep server rooms at safe temperatures.

For today’s high-density racks, Vertiv also offers advanced cooling like rear-door heat exchangers (liquid-cooled doors that absorb heat directly from server racks) and direct-to-chip liquid cooling for the hottest processors.

In short, Vertiv’s cooling gear acts as the “AC and ventilation” for the world’s cloud and AI computing hubs, preventing meltdown and improving energy efficiency.

• Modular Data Center Systems and Enclosures: To help customers deploy capacity quickly, Vertiv provides prefabricated modular data centers and enclosures.

These are essentially pre-engineered “data center in a box” units – self-contained modules equipped with racks, power, cooling, and fire suppression – that can be built in a factory and then shipped to site for rapid installation.

Vertiv’s integrated solutions include outdoor enclosures and micro data centers (like the Vertiv™ SmartRow and SmartMod series) that allow companies to add computing at the edge or expand a main data center without constructing a new building from scratch.

By delivering modules that are already outfitted with power and cooling infrastructure, Vertiv dramatically cuts deployment time (we’ll see later how one solution reduced build time by up to 80%).

These modular systems are increasingly important for edge computing, where operators need to stand up small data centers near end-users (for example, at cell tower sites or factory floors) quickly and securely.

• Monitoring, Management, and Services: In addition to hardware, Vertiv offers software and services to manage infrastructure.

This includes data center infrastructure management (DCIM) software that gives operators remote visibility and control over power and cooling units, as well as services like installation, maintenance, and emergency support.

These ensure that Vertiv’s gear operates optimally throughout its life cycle. (For instance, their new Vertiv™ Unify platform provides a single pane of glass to monitor the entire power and cooling chain across a facility).

While less visible than a hulking UPS or AC unit, these digital management tools and services are key to maximizing uptime and efficiency for Vertiv’s customers.

In summary, Vertiv’s product portfolio spans the gamut of critical infrastructure needed to run modern digital systems.

By covering power, cooling, racks/enclosures, and management, Vertiv essentially acts as a one-stop shop for data center physical infrastructure.

This broad offering is particularly relevant as computing demand soars – especially with emerging trends like generative AI that strain power and cooling limits like never before.

Next, we’ll explore how Vertiv’s solutions specifically support the exploding requirements of AI-focused data centers.

Powering the Generative AI Boom

Easy Button: The new wave of generative AI (like large language models and advanced AI training) requires massive computing power, which in turn demands lots of electricity and cooling.

Vertiv’s systems are designed to handle these extreme conditions, keeping the “AI factories” running by supplying big power and specialized cooling so the supercomputers don’t overheat.

Vertiv has been actively evolving its products to meet the skyrocketing demands of AI hardware.

Generative AI workloads (like training large neural networks or running GPT-style models) concentrate hundreds or thousands of high-end GPUs in clusters – essentially creating “AI factories” that consume enormous power and produce intense heat.

Traditional data center infrastructure can struggle with these extremes, so Vertiv has introduced tailored solutions for high-density AI environments.

For example, the company recently launched a set of new systems in 2025 specifically to address AI challenges: a consolidated management platform (Vertiv™ Unify), a prefabricated high-density overhead power/cooling bus (Vertiv™ SmartRun), a chilled-water rear door cooler for racks (Vertiv™ CoolLoop RDHx), and a high-density 50V DC power shelf (Vertiv™ PowerDirect) (Source) (Source).

Each of these is aimed at safely powering and cooling racks full of AI processors:

• Coping with Extreme Power Draw: A rack of AI servers can draw 20–100+ kilowatts of power, far above a typical enterprise rack.

Vertiv’s power infrastructure is being scaled to handle this.

The Vertiv PowerDirect DC shelf, for instance, can deliver up to 132 kW per rack in an Open Compute Project (OCP) form factor, doubling the power density of some traditional AC UPS setups (Source).

By providing efficient direct current (50V DC) power distribution, it reduces conversion losses and physical footprint – important when every rack is a power hog.

Likewise, Vertiv’s large UPS systems (with lithium-ion batteries for higher performance) and busway distribution products are built to feed these hungry AI rigs reliably.

The goal is to ensure stable, plentiful power so that AI computations aren’t interrupted by any hiccup in electricity supply.

• Dissipating Massive Heat Loads: On the cooling side, generative AI data centers often push beyond the limits of standard air cooling.

Vertiv has responded with advanced cooling techniques.

The Vertiv CoolLoop RDHx rear-door cooler can remove up to ~80 kW of heat per rack via liquid-cooled heat exchangers mounted on the back of server cabinets (Source).

This turns each rack door into a built-in radiator, absorbing heat directly at the source.

For even hotter setups, Vertiv supports direct-to-chip liquid cooling, where coolant flows through cold plates attached to CPUs/GPUs.

Their CoolLoop system can integrate with these loops for a “room-neutral” cooling solution (meaning the heat is captured so efficiently that the room’s ambient temperature stays in balance).

Vertiv also offers high-capacity chillers and evaporative cooling units for facility-wide cooling of AI labs.

In short, Vertiv’s thermal solutions are engineered to prevent AI servers from overheating, using liquid cooling and other innovations to handle what air alone often cannot.

• Faster Deployment at Scale: The AI boom has led to a scramble to build new data center capacity – companies want to spin up AI compute clusters quickly to capitalize on opportunities.

Vertiv is enabling speed through its prefabricated and modular designs.

The Vertiv SmartRun overhead infrastructure, launched in 2025, combines power busbars, liquid cooling piping, and hot aisle containment in a factory-fabricated module that can be lifted into place over a row of racks (Source).

This clever design allows deployment of about 1 megawatt of IT load per day once on-site, which is up to 85% faster than building those systems piece by piece the old way (Source).

Moreover, Vertiv’s 360AI platform (introduced in 2024) provides pre-engineered templates for full AI data centers – including power, cooling, enclosures, and integration services – which Vertiv says can cut deployment times in half (Source) (Source).

The idea is to eliminate lengthy design cycles and on-site construction bottlenecks.

By shipping modular “AI-ready” blocks, Vertiv helps cloud providers and researchers scale up AI compute farms with assembly-line speed, which is crucial given how demand is outpacing traditional build timelines.

• Reference Designs and Partnerships: Vertiv has even partnered with AI chip leader NVIDIA to make sure its infrastructure aligns perfectly with cutting-edge AI hardware.

In fact, Vertiv joined the NVIDIA Partner Network and developed reference designs for NVIDIA’s GPU baseboards (such as NVIDIA’s NVL platforms) (Source).

These reference designs essentially blueprint an optimal power/cooling setup for racks full of NVIDIA AI accelerators, giving customers a vetted solution.

Vertiv’s CEO Giordano Albertazzi noted that their close work with NVIDIA on reference architectures positions Vertiv “at the forefront of AI factory deployment at industrial scale” (Source).

A real-world example is Vertiv’s “iGenius” project in Italy, where they delivered a complete prefabricated AI data center for a leading AI company, including advanced cooling and power infrastructure tailored for AI compute clusters (Source).

This project demonstrated Vertiv’s ability to rapidly deploy AI infrastructure in practice, not just in theory.

All of these efforts underscore that Vertiv is deeply engaged in enabling generative AI – essentially serving as the builder and electrician for AI factories worldwide.

By combining beefed-up power and cooling gear with prefab deployment and strategic alliances, Vertiv has oriented its portfolio to serve the exploding generative AI market.

The company recognizes that AI data centers have unique needs (extreme density, speed to scale, high efficiency), and Vertiv is refining its products to meet those needs head-on.

This positions Vertiv as a key behind-the-scenes enabler of AI growth – whenever you hear about a new cluster of AI supercomputers coming online, there’s a good chance a company like Vertiv provided the power systems, cooling plants, or modular rooms to make it possible.

Positioning for Hyperscale and Edge Growth

Easy Button: Vertiv isn’t just making products – it’s planning ahead to ride the AI and cloud wave.

They’re expanding factories, partnering with big tech like NVIDIA, and offering ready-made solutions so both giant cloud data centers (hyperscalers) and tiny local ones (edge computing sites) can use Vertiv gear easily.

It’s all about being in the right place at the right time as demand for digital infrastructure explodes.

Strategically, Vertiv appears keenly aware that we are in an era of unprecedented growth in digital infrastructure, driven largely by hyperscale cloud providers (like Amazon, Google, Microsoft) and new AI-focused deployments.

The company has taken several steps to ensure it can capture this boom and not be left behind:

• Scaling Manufacturing and Global Footprint: A critical aspect of readiness is making sure you can build and deliver enough equipment on time.

Vertiv has been expanding its manufacturing capacity worldwide to keep up with demand.

In 2024, Vertiv announced a new 215,000 sq. ft. manufacturing facility in South Carolina, expected to create 300 jobs, dedicated to producing integrated modular data centers and power solutions for hyperscale customers (Source).

The company similarly invested in capacity in Mexico, Slovakia, the UAE, and Ireland (Source).

This distributed manufacturing footprint serves multiple purposes: it increases total output (so Vertiv can fulfill large orders quickly) and provides regional flexibility – building closer to the customer to shorten lead times and, not incidentally, to mitigate tariffs (more on that later).

Vertiv’s CEO highlighted that boosting manufacturing is “critical to meeting customer needs” and that the new U.S. plant is central to serving Americas and global demand (Source).

By having factories in the Americas, EMEA, and Asia, Vertiv can better navigate global supply chain constraints and deliver to hyperscalers who themselves operate data centers around the world.

This agility in production is a strategic must in the race to equip new cloud availability zones and AI computing halls being announced seemingly every week.

• Targeting Hyperscale and Cloud Clients: Vertiv’s solutions and sales approach are tuned to hyperscale requirements.

These large tech firms value standardization, scalability, and speed.

Vertiv’s pre-engineered platforms (like the 360AI and modular power/cooling blocks) are tailored for exactly that, allowing a cloud provider to replicate a design across dozens of sites.

Vertiv’s integration capabilities – supplying complete power+cold infrastructure – appeal to hyperscalers who might prefer a single throat to choke for their critical systems, rather than piecemeal vendors.

The strong orders growth Vertiv has reported suggests success in this arena.

In Q1 2025, Vertiv’s book-to-bill ratio was ~1.4, and backlog climbed to $7.9 billion (about 10% higher than at 2024’s end) indicating ongoing large orders from big customers.

Many of these orders likely come from hyperscale and colocation data center operators investing heavily in capacity (often to support AI services).

Vertiv’s strategy is clearly to stay embedded with these key clients, offering them cutting-edge solutions (like the NVIDIA-aligned designs) and reliable delivery.

• Embracing Edge Computing Needs: While hyperscale data centers grab headlines, edge computing is another growth frontier Vertiv is eyeing.

Edge computing refers to smaller data centers near the end-users or devices – for example, micro data centers at telecom base stations, or localized servers in hospitals, retail stores, or factories – aimed at reducing latency and handling data locally.

These sites might be tiny compared to a cloud campus, but they are numerous and expanding as IoT and 5G drive distributed computing.

Vertiv has developed specific edge data center solutions to tap this trend. One example is the Vertiv SmartRow 2, a self-contained row of racks with built-in cooling, power, and remote monitoring, designed to be deployed in non-traditional spaces (like a closet or back room) with minimal site prep.

Using pre-engineered micro data center units like SmartRow, operators can deploy an edge site in a fraction of the time.

In fact, Vertiv cites that such pre-fabricated edge solutions can cut deployment costs by ~30% and speed up deployment by 80% compared to a custom build.

By offering a standardized yet flexible edge product, Vertiv positions itself to supply the coming wave of edge infrastructure build-out.

The edge AI segment (AI computing at the edge) is expected to grow ~21% annually through 2030, and Vertiv is making sure it has a stake in that growth (Source).

The company’s global service network also gives it an edge (pun intended) in supporting far-flung micro-sites, which hyperscale-focused competitors might overlook.

In sum, Vertiv’s strategy encompasses both ends of the spectrum – the giant cloud data centers and the distributed edge nodes – ensuring it can capture opportunities wherever computing proliferates.

• Future-Proofing with R&D and Innovation: Vertiv is investing in engineering to stay ahead of the technology curve.

The company has increased spending on engineering, research & development (ER&D), focusing on next-gen cooling (e.g. hybrid air/liquid systems), higher efficiency power electronics, and integrated management software.

The Q1 2025 commentary noted Vertiv is continuing to invest in R&D and capacity expansion to support growing industry needs, particularly AI deployments.

This proactive approach is strategic: as customer needs evolve (more density, more sustainability, smarter automation), Vertiv aims to have solutions ready.

A practical example of innovation translating to business: Vertiv’s partnership with NVIDIA and early moves into AI-focused designs meant it could quickly capitalize on the AI uptick in 2024-2025.

Similarly, Vertiv’s prior development of lithium-ion battery UPS and dynamic grid support features now plays into trends like data center sustainability and energy storage integration (some large data centers use on-site batteries not just for backup but also to help manage power draw from the grid).

By anticipating such trends, Vertiv intends to remain a go-to provider as the market changes.

In essence, strategic readiness for Vertiv means being technologically and operationally prepared – having the right products, production capacity, and partnerships in place – so that as clients decide to pour money into hyperscale builds or edge rollouts, Vertiv is already there with the “easy button” solutions.

Vertiv’s CEO summed up the situation well: despite heightened demand, “we are still in the early stages of unlocking Vertiv’s full potential,” and by keeping customers future-ready through rapid market evolution, Vertiv aims to create long-term value as the market expands (Source).

The company’s aligned strategy for the AI era and edge computing boom suggests it is not resting on legacy offerings, but proactively positioning itself as an essential partner in the next chapter of digital infrastructure growth.

Q1 2025 Financial Performance Highlights

Easy Button: Vertiv’s latest quarterly results show a big growth spurt – they sold a lot more equipment than the year before and made higher profits.

The company is getting more orders than it can fill immediately (building a hefty backlog), which means strong demand going forward.

They even raised their sales outlook for the year, confident that the AI and data center boom will keep fueling their business.

Vertiv reported strong financial results for the first quarter of 2025, reflecting the surging demand for its data center infrastructure solutions.

The current valuation appears appropriate: neither stretched nor cheap:

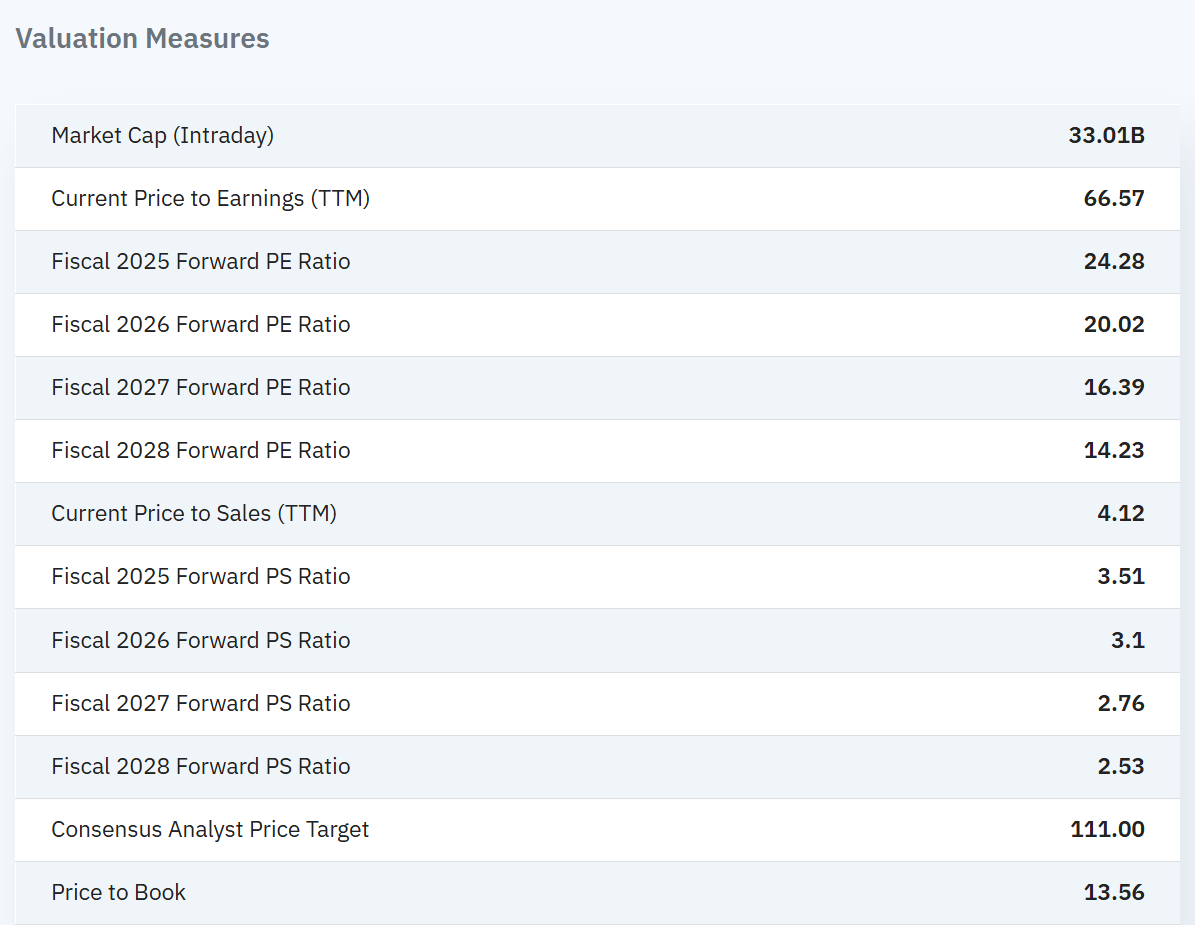

And here are growth estimates:

Key highlights from Q1 2025 include:

• Robust Revenue Growth: Net sales in Q1 2025 were $2.036 billion, up 24% from the same quarter a year ago (Q1 2024) (Source) (Source).

Organically (excluding any currency or acquisition effects), revenue grew ~25%, indicating genuine volume growth.

This is a hefty jump, illustrating how Vertiv is riding the wave of data center expansion.

Notably, growth was led by the Americas and Asia-Pacific regions – Vertiv’s sales in the Americas grew ~28% year-on-year (organic) and APAC sales grew about 36%, while EMEA (Europe, Middle East & Africa) saw mid-single-digit growth (Source) (Source).

The especially high growth in the U.S. and Asia suggests hyperscale cloud and telecom investments are booming in those markets, and Vertiv is capturing that demand.

A positive sign for future sales: orders (new bookings) continued to outpace revenues. Vertiv’s trailing twelve-month orders were ~20% higher than the prior period, and Q1 orders were up ~13% year-over-year (Source).

The book-to-bill ratio was about 1.4x, meaning for every $1 of product shipped they booked $1.40 in new orders – thus the backlog climbed further to $7.9 billion by quarter’s end (about 25% higher than backlog a year ago) (Source) (Source).

This towering backlog of nearly $8B (roughly equivalent to almost a full year’s sales) gives Vertiv a revenue cushion for upcoming quarters and underscores that customers (likely big data center operators) have Vertiv gear on order for projects throughout 2025.

• Improved Profitability: Vertiv’s profits grew even faster than sales, thanks to better operating leverage and pricing.

Q1 2025 operating profit was $291 million, up 43% from a year ago, and on an adjusted basis operating profit was $337 million (up 35% year-on-year) (Source).

Adjusted operating margin expanded to 16.5% in Q1, compared to 15.2% a year ago (Source).

This 130 basis point margin improvement was achieved despite some headwinds from tariffs (discussed later); it was driven by higher volumes (spreading fixed costs over more sales), favorable price/cost (Vertiv raised prices in prior periods to offset inflation, and those are now boosting margins), and productivity gains.

Bottom-line earnings were also strong: adjusted diluted EPS came in at $0.64, up ~49% from $0.43 a year ago (Source) (Source).

On a GAAP basis, EPS was $0.42 (versus essentially breakeven -$0.02 in Q1 2024), the GAAP difference mainly due to some accounting for warrant liabilities last year.

The key point is that Vertiv is significantly more profitable than it was a year ago, indicating good execution on cost management and pricing.

This is a marked turnaround from early 2022 when supply chain issues hurt margins – the company’s efforts to recover profitability (through pricing actions and cost control) are bearing fruit.

• Cash Flow and Balance Sheet: Vertiv generated $265 million in adjusted free cash flow in Q1 2025, a big improvement of +$164 million versus the $101 million in Q1 2024 (Source) (Source).

Strong cash flow was aided by the higher profits and better working capital management (for instance, Vertiv has been managing inventory and supplier payments more efficiently as supply chain pressures normalize).

With this cash generation, Vertiv’s leverage has come down – net debt to EBITDA is about 0.8x now, which is very low (Source).

In fact, Vertiv’s balance sheet has strengthened to the point that Fitch Ratings upgraded Vertiv to investment grade (BBB-) in Q1 2025 (Source).

This is a notable milestone; it reflects confidence in Vertiv’s financial stability and should help reduce borrowing costs.

The company’s liquidity stands at a healthy $2.3 billion (cash + available credit).

All told, Vertiv’s financial footing is solid: it is profitable, cash-flow positive, and carries a manageable debt load for its size.

This gives Vertiv flexibility to continue investing in growth (new factories, R&D, etc.) and weather any surprises.

• Guidance Upward Revision: Given the strong start, Vertiv modestly raised its full-year 2025 sales outlook.

The company increased its 2025 revenue guidance by $250 million (at the midpoint), now expecting about $9.45 billion in sales for 2025 (which would be 17-19% organic growth for the year).

Importantly, they maintained guidance for full-year adjusted operating profit ($1.93B midpoint) and EPS ($3.55 midpoint), even as sales projections rose – implying they expect to reinvest some of the extra revenue into capacity and possibly absorb some tariff costs, rather than flow all upside to profit.

Still, the full-year outlook calls for an adjusted operating margin of ~20-21% (up from ~16% last year), which suggests further margin expansion as the year progresses.

For the upcoming Q2 2025, Vertiv guided to $2.325–2.375B in sales (19–23% organic growth) and adjusted EPS of $0.77–0.85.

These numbers signal that Vertiv sees the demand trend continuing and expects a very strong 2025 overall, fueled by ongoing data center and AI infrastructure spending.

The fact that management didn’t boost EPS guidance while raising revenue (likely due to cautious assumptions on tariffs and investments) shows prudent planning – they are not overpromising on profit, given some uncertainties in costs.

In summary, Vertiv’s Q1 2025 performance was impressive: double-digit growth and rising margins.

The results confirm that the company is successfully capitalizing on the current upcycle in digital infrastructure.

Vertiv’s large backlog and raised sales forecast point to confidence that 2025 will be a banner year.

The financial momentum provides a strong backdrop as we examine other aspects like trade policy impacts and competition.

Of course, no discussion is complete without noting possible headwinds – one of which has already made a cameo in the margin discussion: tariffs.

Tariffs, Trade Policy and Supply Chain Impacts

Easy Button: Global tariffs and trade wars (like the U.S. tariffs from the Trump era) have made some parts and materials more expensive for Vertiv.

In other words, taxes on imported goods can drive up Vertiv’s costs to build its power and cooling equipment.

Vertiv is responding by shifting production across countries and tweaking its supply chain to dodge or lessen these extra costs.

The trade environment is tricky, but the company is taking steps (like more factories in different places and adjusting prices) to protect itself and customers as much as possible.

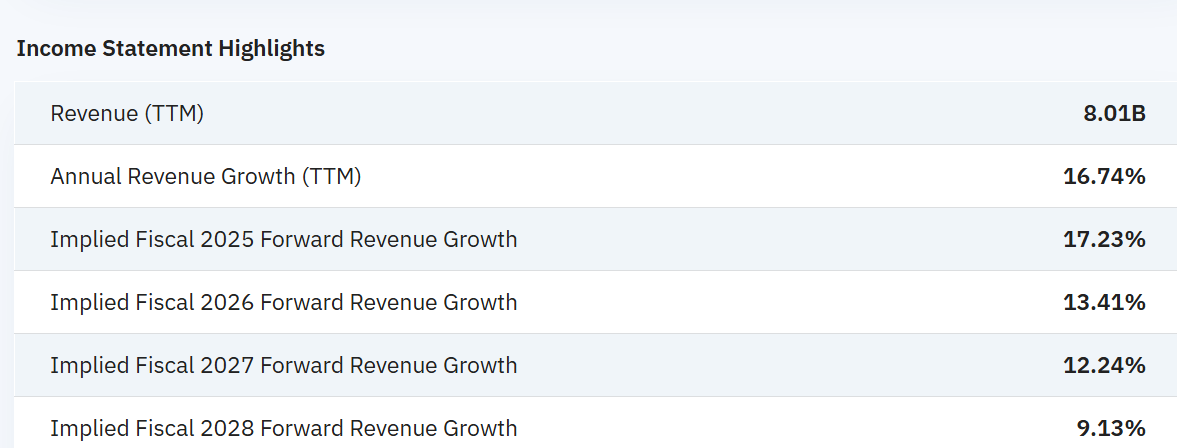

Before we dive in, here is snapshot from VRT’s Q1 earnings report that addresses tariffs:

Vertiv operates a global supply chain – sourcing components like electronic parts, metal enclosures, batteries, etc., and manufacturing in multiple regions.

This means it is directly affected by international trade policies and tariffs. In recent years, Trump-era tariffs and other global duties have introduced significant cost headwinds.

For context, the U.S. imposed broad tariffs on Chinese-made goods under Section 301 (25% tariffs on many electronics and machinery categories) and tariffs on steel/aluminum imports (25% on steel) among other measures.

These impact equipment manufacturers like Vertiv because many components or raw materials became more expensive to import.

Vertiv’s Q1 2025 results explicitly call out “increased tariffs” as a factor that partially offset some of their margin gains (Source) (Source).

In other words, while Vertiv’s pricing and efficiency helped profits, tariffs ate away a portion of that by raising costs.

To illustrate, Vertiv noted that assuming tariff rates as of April 22, 2025 remain through year-end, they expect to progressively lessen the tariff impact as 2025 goes on (Source).

This statement implies tariffs were hitting their cost of goods in early 2025, but they plan to take mitigating actions.

What actions?

Vertiv mentioned its “diverse manufacturing footprint, operational flexibility, and commercial strategies” as tools to counter tariffs (Source).

In practical terms, this means:

• Shifting Supply Chains: Vertiv can move production of certain products to facilities in countries with more favorable trade status.

For example, to serve U.S. customers without incurring China tariffs, Vertiv might manufacture more units in Mexico or the U.S. (Mexico is not subject to Section 301 tariffs and, under USMCA, avoids earlier threatened tariffs).

The new plant in South Carolina and expanded Mexican operations make it easier to source and build within North America, reducing reliance on Chinese imports.

Similarly, for European markets, using factories in EMEA avoids EU import duties.

This multi-hub production approach is a direct way Vertiv is mitigating tariff costs – essentially producing “local-for-local” to bypass punitive import taxes.

By Q1 2025, they were already leveraging this: the company said it’s increasing capacity in places like Mexico and Slovakia (Source), partly to navigate the tariff environment.

• Tariff Engineering and Exemptions: Vertiv can adjust product designs or supply routes to fit tariff exemptions.

U.S. tariffs have complex codes; some sub-components might be exempt or have lower rates.

Vertiv’s product teams likely explore using alternative parts or suppliers from non-tariffed countries when feasible, a practice known informally as “tariff engineering.”

Additionally, governments sometimes grant exemptions for specific items (or companies can apply for exclusions).

Vertiv keeps an eye on such opportunities – in fact, they updated guidance to reflect tariff rates active as of April 22, 2025, meaning they’re closely tracking policy changes and have baked in what’s known now, but remain ready to adjust if something changes.

• Commercial Strategies (Pricing): When costs do go up from tariffs and cannot be avoided, Vertiv has been passing at least some of those costs to customers via price increases or surcharges.

The improved gross margins over the past year indicate that Vertiv successfully implemented price hikes (during 2022–2023) to counter general inflation and tariff impacts.

While no customer likes price bumps, the strong demand environment has likely made it easier for Vertiv to charge more.

Vertiv’s comment that its strategies will lessen tariff impact as 2025 progresses suggests it expects to offset those costs – either through further pricing adjustments or cost reductions elsewhere.

The risk here is if tariffs increase beyond current levels unexpectedly, it could outpace their pricing power.

As of the latest guidance, Vertiv assumes existing tariffs stay constant through 2025, and they have incorporated those into their outlook (for example, they enumerated in a footnote the various tariffs in effect, including Section 301 China tariffs, steel tariffs, etc., to be clear about assumptions) (Source).

The “tariff environment remains fluid,” Vertiv noted, acknowledging uncertainty (Source).

Trade tensions between the U.S. and China persist into 2025, so the 25% tariffs on a broad range of China-sourced components are still in place.

Moreover, geopolitical factors (like sanctions or export controls) could indirectly affect supply lines.

Vertiv also references global trade conflict as a risk – beyond U.S.-China, there’s potential EU-China spats or other regions imposing protectionist measures.

For instance, if Europe were to set tariffs on certain U.S. or Asian goods, or if currency swings due to trade issues raise costs, Vertiv would feel it.

Medium-term, tariffs and trade policies can influence the AI infrastructure investment climate in a few ways:

• Higher Project Costs: Tariffs effectively act as a tax on building data centers.

If key equipment costs more, the total cost for, say, a new AI data center might be higher than it would otherwise.

This could potentially slow down some projects or shift where they happen.

For example, a cloud provider might delay a U.S. build-out or choose to expand in a country with fewer import taxes if costs escalate too much.

Vertiv and its customers are watching this calculus.

So far, demand is so robust that projects are proceeding, but continued or increased tariffs could eventually make data center expansion more expensive and possibly dampen the pace if budgets hit a ceiling.

• Localization of Production: On a more positive note for Vertiv, the drive to localize production (partly due to tariffs) means Vertiv has invested in new facilities (as we discussed).

In the medium term, this could make Vertiv more resilient and responsive.

They won’t be as tied to one country’s trade policy if they can build from multiple hubs.

So, paradoxically, the tariff pressure is forcing a beneficial evolution in Vertiv’s supply chain – one that could become a competitive advantage if they handle it well (not all competitors have such an expansive footprint).

• Component Sourcing Challenges: Vertiv still needs a lot of electronic parts (circuit boards, chips, etc.) which often come from Asia.

Tariffs on those can strain relationships or require renegotiation with suppliers.

Also, if China were to retaliate or restrict exports of certain materials (rare earth metals, etc.), that could bite.

Vertiv’s mention of using “supply chain countermeasures” implies they are qualifying alternate suppliers and keeping extra inventory where needed to avoid being caught off guard by trade disruptions (Source).

This is part of the broader risk management in the current climate of trade uncertainty.

In Q1’s report, Vertiv stated that while tariffs are a headwind, they expect to “significantly mitigate the effect of tariffs as we enter 2026.” (Source) (Source).

This suggests a medium-term plan is in place: likely by 2026 they will have fully adjusted their operations (locations of manufacturing, supplier base, and any pricing strategies) such that tariffs won’t meaningfully dent margins.

It’s an ambitious goal but signals that Vertiv is actively working the problem.

They also caution that the situation is fluid – meaning if a new round of tariffs or an escalation in trade conflict occurs, it’s a variable to watch.

In summary, tariffs have been a drag on Vertiv’s costs, but the company is navigating it through global diversification and smart supply tweaks.

The current investment climate for AI infrastructure is so strong that it has outweighed these cost issues for now – companies are pressing ahead with data center builds despite higher costs.

Vertiv, for its part, is making sure it isn’t caught flat-footed: they’re adapting so that whether or not geopolitical winds blow favorably, Vertiv can continue delivering to customers with minimal disruption.

Trade policy remains a risk factor (and something to monitor in their quarterly results for margin impacts), but Vertiv’s proactive stance should blunt the worst of it, keeping the focus on growth.

Competitive Landscape and Comparative Risks

Easy Button: Vertiv isn’t alone – several big companies around the world also make power and cooling gear for data centers.

Giants like Schneider Electric and Eaton compete for the same customers, and even some tech firms (like Huawei) offer similar solutions, especially overseas.

Each rival has its strengths – some are huge with deep pockets, others have cutting-edge tech – so Vertiv must continue to innovate and execute well to stay ahead.

Competition means Vertiv can’t get complacent, as customers have choices when building their critical facilities.

Vertiv operates in a competitive global market for critical infrastructure.

Its peers range from large diversified electrical equipment companies to specialized data center solution providers.

According to industry comparisons, Vertiv’s top competitors include global giants like Schneider Electric, Eaton, and Legrand, as well as players such as Siemens, Huawei, and Rittal, among others (Source).

Below we identify a few key rivals and the comparative risks they pose:

• Schneider Electric (France): Schneider is often cited as Vertiv’s #1 competitor.

Through its APC and Secure Power divisions, Schneider offers a full suite of data center power (UPS, PDUs, switchgear) and cooling (InRow coolers, chillers) products similar to Vertiv’s lineup.

Schneider is a massive company (over $30B revenue) with a broad reach in energy management and industrial automation.

Comparative Risks:

Schneider’s sheer scale and resources mean it can invest heavily in R&D and potentially undercut on price if needed.

It also has a global service network and brand trust.

Notably, Schneider is actively targeting the AI infrastructure space as well – for instance, in 2024 Schneider partnered with NVIDIA to release AI data center reference designs of its own (Source) (Source).

This mirrors Vertiv’s moves and shows Schneider is determined not to cede any ground in the high-density AI segment.

Schneider’s advantage is a broader portfolio (including things like building management and electrical distribution integration) and its ability to offer turnkey solutions (they even own AVEVA for data center digital twins, etc.).

The risk for Vertiv is that a one-stop-shop customer might choose Schneider for an entire smart building including the data center, leveraging Schneider’s end-to-end offerings.

Vertiv must continue to differentiate with cutting-edge technical performance and agility in meeting customer needs to compete with this behemoth.

• Eaton (Ireland/USA): Eaton is another heavyweight in power management.

It makes UPS systems (it acquired legacy brands like Powerware and Tripp Lite), power distribution gear, and some cooling and rack solutions.

Eaton’s revenue (>$20B) and market presence in electrical equipment make it a formidable rival in the data center power niche.

Comparative Risks:

Eaton tends to be very strong on the power side (industrial-grade UPS, grid interface solutions) and has a wide sales channel.

It might not have as comprehensive a thermal portfolio as Vertiv or Schneider (Eaton historically focused more on power quality and less on precision cooling), but it’s been expanding via acquisitions (e.g., it now sells rack PDUs and IT enclosures through Tripp Lite’s product line).

Eaton’s large size allows it to weather cost pressures easily and potentially offer package deals bundling power infrastructure with other electrical gear for a facility.

A risk is if Eaton leverages its broader customer base in commercial power to pull more data center deals (for instance, an enterprise that already buys Eaton switchgear might be sold on Eaton for the data center UPS too).

However, Eaton’s “full critical infrastructure” offering is slightly less expansive than Vertiv’s (which could be an edge for Vertiv).

Vertiv should watch Eaton’s moves in emerging tech – e.g., if Eaton pushes into lithium-ion UPS or DC power aggressively, it could challenge Vertiv’s edge in those areas.

• Huawei (China): Huawei’s Digital Power division has become a major global supplier of data center power and cooling solutions, especially outside North America.

Huawei offers high-efficiency UPS systems, modular data center solutions, battery storage, and cooling units (including liquid cooling), often at competitive price points.

Comparative Risks:

Huawei’s strength lies in its ability to leverage low-cost manufacturing and its technology expertise (born out of telecom equipment) to produce very price-competitive, integrated solutions.

In markets like Asia, Middle East, Africa, Huawei is a fierce competitor for data center builds – many telecom companies or cloud providers in those regions use Huawei’s prefabricated data centers and power systems.

The geopolitical context is a double-edged sword: while Huawei is effectively barred from U.S. projects (and some European ones due to bans), it faces no such restriction in many developing markets.

Huawei reportedly has grown its power and digital energy business rapidly; this poses a risk that Vertiv could be edged out in high-growth regions on cost or local presence grounds.

To compete, Vertiv cannot rely on the U.S. market alone – it must keep up its game globally, emphasizing quality, reliability, and compliance (some Western customers prefer non-Chinese vendors for security reasons, which can favor Vertiv).

Also, Huawei’s scale in electronics could allow it to innovate (e.g., very high efficiency UPS, AI-driven cooling optimization) quickly.

Vertiv’s counter strategy is likely focusing on premium performance and avoiding direct price wars, while capitalizing on regions where Huawei faces barriers.

• Legrand (France): Legrand is a multinational known for electrical and digital building infrastructures.

In the data center space, it owns brands like Server Technology and Raritan (power distribution and KVM switches), and offers aisle containment and cooling solutions (though cooling is not its primary business).

Comparative Risks:

Legrand competes more in specific niches – for example, rack PDUs and monitoring (where Raritan is a direct rival to Vertiv’s Geist PDUs and Avocent management tools).

Legrand’s risk to Vertiv is that it can nibble away at segments of the portfolio (like intelligent rack power strips or IT management software) which are part of Vertiv’s offering.

However, Legrand doesn’t supply large UPS or CRAH units, so it’s not a full direct competitor for turnkey projects.

The risk is more fragmentation: a customer might mix-and-match (e.g., choose Legrand for rack-level power and Vertiv for room cooling).

Vertiv mitigates this by stressing integration (selling the value of having everything work together).

• Rittal (Germany) and Other Private Players: Rittal is a private German company renowned for IT racks, enclosures, and cooling units.

They, along with others like Stulz (cooling specialist), Delta Electronics/Eltek (power electronics), and various regional firms, form a competitive mosaic globally.

Comparative Risks:

Rittal, in particular, has a strong presence in Europe and offers modular data centers and cooling.

They often partner with others (e.g., Rittal has worked with HPE on edge data center kits).

The risk from such players is targeted competition: they might win deals in their home regions or specific verticals (e.g., automotive industry data centers in Germany might favor Rittal for historical reasons).

Vertiv must continually prove its value and maintain strong relationships to fend off these capable mid-size competitors.

Many of these firms also innovate in their niches – for example, a company like Green Revolution Cooling (GRC) in the U.S. (immersion cooling startup) could introduce disruptive cooling tech that challenges traditional cooling approaches Vertiv sells.

While such startups are smaller, Vertiv keeps an eye on them and has even introduced its own versions of emerging tech (like liquid cooling) to stay current.

• Server and IT Hardware OEMs: While not traditional competitors, there’s an angle where server manufacturers (like Dell, HPE, or Supermicro) sometimes offer integrated solutions (racks with servers, power, cooling in one package).

For instance, HPE has offered turnkey edge pods with IT and power inside.

Comparative Risks:

If large IT vendors bundle more infrastructure with their servers, it could encroach on Vertiv’s territory by providing an alternative one-stop solution (e.g., a customer buying a “data center in a shipping container” directly from an IT company).

However, typically those IT vendors partner with companies like Vertiv or Schneider to supply the power/cooling portion.

Indeed, the AlphaSpread analysis notes that Vertiv and server-makers like Supermicro primarily complement each other – one provides physical infrastructure, the other provides computing – though in integrated deals they might compete to offer the better overall package (Source).

The takeaway is that Vertiv must maintain strong partnerships with IT system integrators so that it remains the default choice for the infrastructure piece, rather than a competitor.

In a broader sense, the competitive risk is that the data center infrastructure market, while growing, will attract aggressive plays from these rivals.

Price competition could squeeze margins industry-wide. Larger competitors might use profits from other divisions to subsidize deals in this space.

Additionally, if a competitor comes out with a significantly more efficient or innovative solution (say, a cooling system that’s far greener or a battery tech that’s superior), Vertiv could lose edge unless it matches quickly.

Vertiv’s strengths in this competitive field are its comprehensive portfolio and focus – it is one of the few purely concentrated on critical digital infrastructure (whereas Schneider, Eaton, etc., have many other business lines).

This focus, plus Vertiv’s now improved financial position, means it can invest and respond rapidly to customer needs.

But the company must execute well: any slip in product quality, support, or delivery could cause customers to switch to the many alternatives available.

Given how mission-critical these systems are, reputation matters; Vertiv will aim to continue building a name for reliability and innovation to set itself apart.

Finally, it’s worth noting that market demand is robust enough that multiple players are thriving – this is not a zero-sum game in the near term.

Vertiv’s record orders and Schneider’s growth, for example, show a rising tide.

The true test will come if/when the market growth slows: then competition could turn into a more intense fight for market share.

For now, Vertiv appears to be holding its own among the giants, leveraging its agility and deep domain experience (it’s the successor of Emerson Network Power, thus carrying decades of know-how).

Keeping an eye on competitors’ moves (like Schneider’s AI reference designs or Huawei’s expansion) and continually improving its offerings will be crucial for Vertiv to maintain and grow its position in this dynamic landscape.

Risks

The tariff situation evolves (a relief or removal of some tariffs could boost Vertiv’s margins, whereas new trade barriers would be a headwind), whether component shortages (like chips) resurface (currently easing, but always a concern in electronics-heavy businesses), and competitive pricing pressure if the market growth slows or if any competitor tries to buy market share.

Also, as Vertiv serves extremely large projects, the timing of a few hyperscale projects can swing results; effective project and backlog management will be important to avoid bottlenecks or customer dissatisfaction.

Competition is real.

Finally, a recession could soften the AI build out.

Conclusion and Outlook

Vertiv has positioned itself as a key enabler of the digital and AI revolution, with strong momentum going into the future.

The company’s challenge will be to stay ahead of rising competition and manage external risks (like trade policies), but if it continues innovating and executing well, Vertiv is set to ride the AI infrastructure wave for years to come.

Looking forward, Vertiv’s trajectory appears strongly aligned with megatrends in technology.

The proliferation of AI services, cloud computing, 5G, and edge devices all point to continued heavy investment in data centers and distributed computing infrastructure.

Vertiv essentially builds the foundational systems for these trends, which puts it in a favorable spot.

Its recent financial results and growing backlog reflect that tailwind.

However, success is not guaranteed – Vertiv must navigate the “growth with discipline” balance.

On one hand, it needs to ramp up capacity and innovate fast to seize the opportunities (which it is doing via new products and factories).

On the other hand, it must manage the pitfalls: controlling costs in the face of tariffs and inflation, ensuring supply chain reliability, and avoiding overextension.

The company’s improving margins and cash flow indicate it learned lessons from past hiccups and is more resilient now.

If generative AI and cloud growth continue as expected, Vertiv stands to benefit handsomely – provided it hits the easy button on execution and keeps the power on and cooling flowing for its customers.

Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories (“The Company”) does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if we have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.